massachusetts estate tax rates table

The table below lists all of the rates. Acushnet Center MA Sales Tax Rate.

Massachusetts Income Tax Calculator Smartasset

Abington MA Sales Tax Rate.

. IRS Form 1041 gives instructions on how to file. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. The top estate tax rate is 16 percent exemption threshold.

This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. 352 rows Property tax rates are also referred to as property mill rates. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax Includes information and forms.

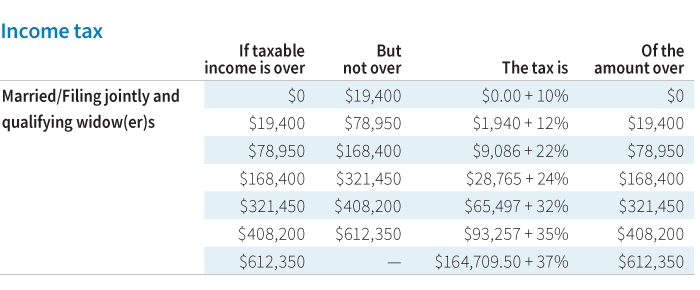

Example - 5500000 Taxable Estate - Tax Calc. This increases to 3 million in 2020 Mississippi. For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income.

The highest trust and estate tax rate is 37. Massachusetts Estate Tax Rates Highlighted Section. The tax rate works out to be 3146 plus 37 of income over 13050.

17 rows Tax year 2022 Withholding. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. COVID-19 Vaccine Trust the Facts.

In Massachusetts an estate tax is generally applied to estates which exceed 1 million based on a progressive rate scale with rates starting at 08 and increasing to 16. US Estate Tax Return Form 706 Rev. Allston MA Sales Tax Rate.

Massachusetts has an estate tax on estates over 1 million. The Massachusetts estate tax calculation is based on the federal credit for state death taxes in effect on December 31 2000 see Massachusetts Estate Tax Return Form M-706. Everyone whose Massachusetts gross income is 8000 or more must file a Massachusetts personal.

No estate tax or inheritance tax. It applies to income of 13050 or more for deaths that occurred in 2021. The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes.

Adams MA Sales Tax Rate. The credit on 400000 is 25600 400000 064. 5000000 - 60000 4940000.

No estate tax or inheritance tax. 50 personal income tax rate for tax year 2021. Agawam MA Sales Tax Rate.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. The estate tax rate for Massachusetts is graduated. Certain capital gains are taxed at 12.

If youre responsible for the estate of someone who has died you may need to file an estate tax return. 402800 55200 5500000-504000046000012 Tax of 458000 Thoughtful estate planning is very important especially for those that wish to leave assets to their beneficiaries or heirs without being impacted by significant taxes. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states.

Acton MA Sales Tax Rate. Massachusetts Estate Tax Rate. Additionally because the taxable estate of 5000000 exceeds 1000000 the estate tax due is 391600.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000. Using the table this tax is calculated as follows. A properly crafted estate plan may.

Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts Estate Tax Return. Accord MA Sales Tax Rate. Acushnet MA Sales Tax Rate.

An estate valued at 1 million will pay about 36500. Your estate will only attract the 0 tax rate if its valued at 40000 and below. Total Sales Tax Rate.

The top estate tax rate is 16 percent exemption threshold. Alford MA Sales Tax Rate. No estate tax or inheritance tax.

If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you would not be taxed more than 16. In the second column youll see the base taxes owed on wealth that falls below your bracket. 22 rows Massachusetts Estate Tax Rates.

In this example 400000 is in excess of 1040000 1440000 less 1040000. Reopening Massachusetts Apply for unemployment benefits Governor Updates Passenger Class D Drivers Licenses SNAP benefits formerly food stamps Personal Income Tax COVID-19 Funeral Assistance. Up to 100 - annual filing.

Massachusetts estate taxes. The maximum credit for state death taxes is 64400 38800 plus 25600. The Massachusetts estate tax for a resident decedent generally is the Credit for State Death Taxes.

Estate tax rates range from 08 to 16. To figure out how much your estate will need to pay in estate taxes first find your taxable estate bracket in the chart below.

Massachusetts Income Tax Calculator Smartasset

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do State And Local Individual Income Taxes Work Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

State Corporate Income Tax Rates And Brackets Tax Foundation

Massachusetts State 2022 Taxes Forbes Advisor

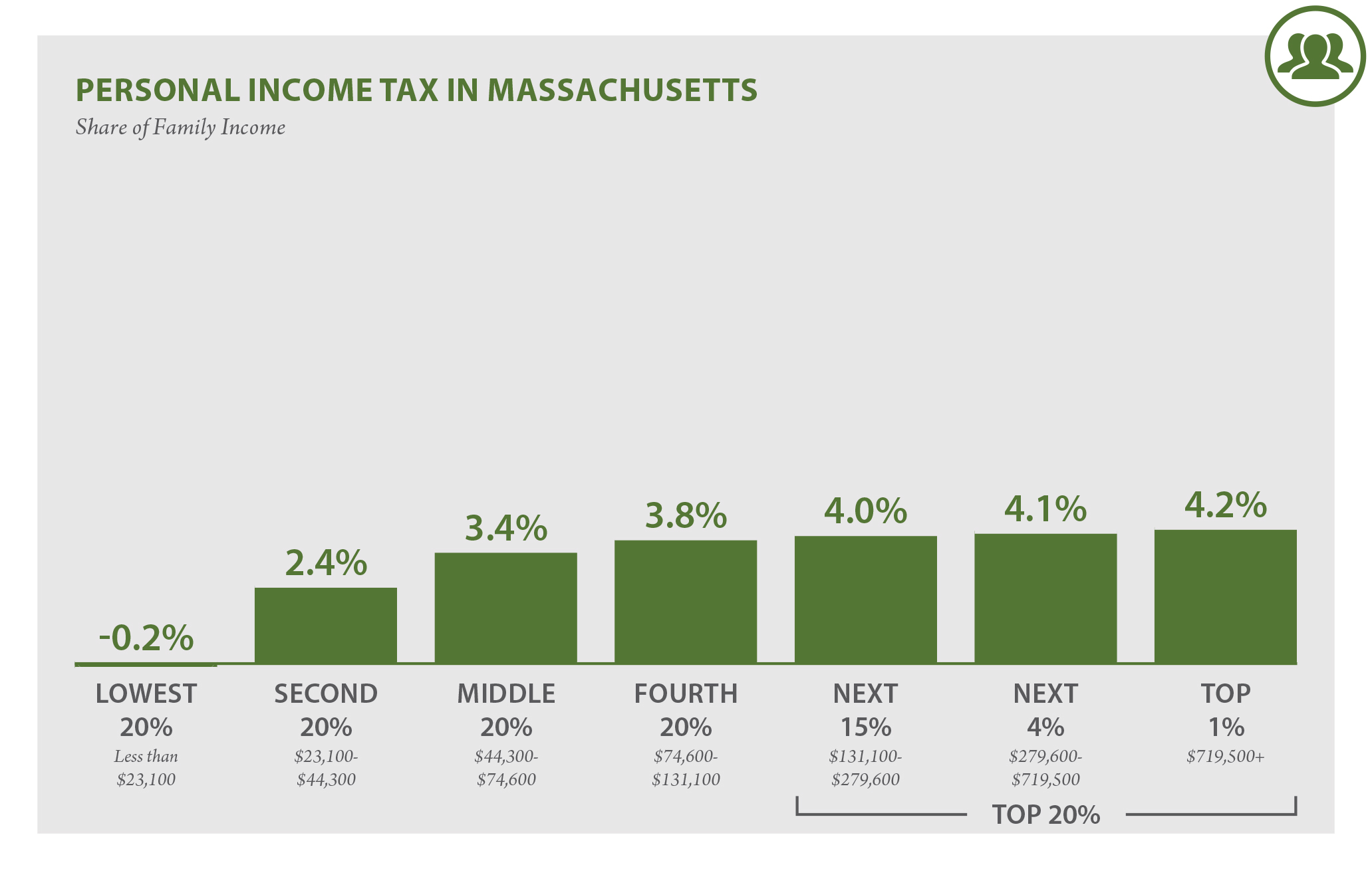

Massachusetts Who Pays 6th Edition Itep

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

The Kiddie Tax Changes Again Putnam Investments

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Is Tax Liability Calculated Common Tax Questions Answered

Opinion The Smartest Way To Make The Rich Pay Is Not A Wealth Tax The Washington Post

Massachusetts Income Tax Calculator Smartasset

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

Massachusetts Estate Tax Everything You Need To Know Smartasset

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How Do State Estate And Inheritance Taxes Work Tax Policy Center